With COVID-19 having gone to Alert Level 4, one thing is obvious – we are all in this together and no one will be exempt from it’s impact. But as with the 1981 Global Recession, the 1987 Stock Market Crash and the Global Financial Crisis of 2008, we will get through this and we will bounce back to be stronger than before. New Zealand continues to benefit from strong positive migration and events like this, tell us how lucky we are to live here and that others from around the world will continue to be attracted here as well.

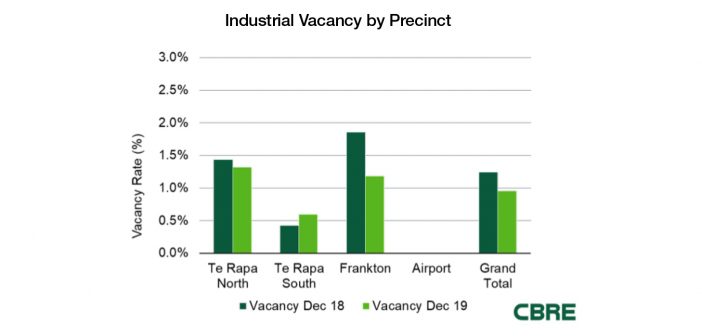

Hamilton and the Waikato are experiencing consistently strong actual growth – projects that are actually under way, not just pipe dreams. Talking to the NAI Harcourts Hamilton industrial sales and leasing team, consisting of Theo de Leeuw, Sean Stephens, Scott Sander and Aaron Donaldson, the overall industrial vacancy has decreased to 1.0 percent representing a 3040 square metre decrease of vacant space, the lowest vacancy rate on record.

What does the Hamilton Industrial market consist of?

Monitored industrial building stock measures 1.91 million square metres and previously just encompassed the areas of Te Rapa and Frankton. The most recent survey includes the introduction of the airport precinct (Titanium Park), which has added some 115,000sqm of industrial building space to the survey. This precinct includes large operations for the likes of Torpedo 7 and Visy Board Hamilton, a wholly owned New Zealand subsidiary of global packaging and paper giant Visy Industries, with a new build of 33,000sqm on a 5.7ha site for Trade Depot, which is currently under construction.

Which area of the industrial market saw the most development?

It’s no surprise that Te Rapa North experienced the largest increase of net supply over the past 12 months, growing by 48,166sqm. Most of this came from the stock additions on Arthur Porter Drive for Tool Shed, Agpak, Origin Glass and Metro Couriers, totalling approximately 23,600sqm. Other stock additions in this precinct included 1928sqm at 25 Clem Newby Road for NZ Windows, two units totalling 1221sqm for VPCM and Dempsey Wood at 21 Chalmers Road, and 1000sqm at 19 Gilbek Place for Holah Homes.

Which area saw the largest decrease in vacancy?

The overall vacancy rate has reduced over the course of the past year and is currently sitting at 1.0 percent.

Frankton saw the largest decrease in vacancy (by 0.7 percent) over the past year, as a result of an active leasing market. The largest lease was a 1990 sqm space at 1 Edgar Street by TFI Tyres.

Vacancy in Te Rapa North decreased by 0.1 percent as a result of five take-ups of previously vacant space and four new vacancies. Of the new vacancies over 1000sqm, two are spec builds: 3171sqm at 35 Clem Newby Road and 1558sqm at 600 Arthur Porter Drive.

Vacancy in Te Rapa South increased by 0.2 percent to 0.6 percent in the 12 months to December 2019, with the largest new vacancy at 30 Sunshine Avenue after AuroLink and Concrete Products vacated their 1694sqm space.

The newly added airport precinct has only two small vacant industrial spaces available, providing a vacancy rate that is not significant enough to currently register.

Theo de Leeuw, director industrial sales and leasing, says: “The Hamilton industrial market experienced robust developer and occupier activity throughout 2019. Completed new developments amounted to some 77,000sqm, yet industrial vacancy decreased, with positive results recorded across all grades and geographic industrial areas of Hamilton.

“The healthy supply pipeline, especially in Te Rapa North and Titanium Park, together with an increasing number of speculative developments, are evidence of high developer confidence and occupier demand, reinforced by the strong economic performance of the Waikato region.”

According to Scott Sander, Frankton sales and leasing specialist: “Frankton, which includes a relatively high percentage of owner-occupiers, has also benefited from its supply of cost-effective space in comparison to new build options and its central Hamilton location, being close to the CBD and State Highway 1.”

Theo De Leeuw suggests that the outlook remains positive, despite COVID-19 “As a result of intensive land rezoning in the past few years, there is sufficient industrial land capacity in Hamilton, not only in some of the monitored suburbs, but in emerging new areas as well. Horotiu, Rotokauri, Ruakura and Hautapu all have significant industrial land capacity, and are expected to benefit from improved transportation networks and the strong economic performance of the ‘golden triangle’ of Auckland, Hamilton and Tauranga. The regional industrial market growth has also experienced benefit from the improved transport linkages and expressway connections with other markets, putting pressure on the vacancy levels in regional towns as well. ”

Pressure on Industrial demand will continue beyond 2020 – what will the financial impact of COVID-19 be? We don’t know, other than to say that Hamilton and the Waikato is possibly positioned better than anywhere else in the country. So let’s all keep safe and remain positive, we will get through this together.